Tuesday, 13 December 2011

Sunday, 4 December 2011

'Beware of Greeks bearing bonds' - Vanity Fair, Oct 2010

This article will be the basis for the A2 Economics lesson in the last week of term. It’s quite long, but is a devastating (and entertaining) portrayal of some of Greece's fiscal problems, and how they arose. It is written by a well-known writer on Business and Economics, Michael Lewis (his book Liar's Poker is a must-read for anyone considering investment banking as a career).

The Unit 4 content includes government fiscal policy, taxation and macroeconomic stability. This is a highly topical example that has directly contributed to the Eurozone's current problems and the 'highly threatening' macro-economic environment we find ourselves in. As such, there could well be a question on these issues in this summer's exam.

YOUR TASK

Create a presentation on

1. Why were Greece's debts and budget deficit so much greater than they reported?

2. Why was their tax income so much lower?

3. What problems did this create for Greece?

Have a good half-term!

Create a presentation on

1. Why were Greece's debts and budget deficit so much greater than they reported?

2. Why was their tax income so much lower?

3. What problems did this create for Greece?

Have a good half-term!

Fiscal union for the Euro? ‘Merkozy’ to the rescue

The Euro currently fails any test for a coherent monetary union.

The ‘convergence criteria’ for membership of the Eurozone laid down by the Maastricht treaty, whereby government deficits should not exceed 3% of GDP and gross government debt should not exceed 60% of GDP, are no longer met by any Eurozone countries (although Germany’s ‘stability programme’ has recently brought its budget deficit within the limit).

Robert Mundell in his 1961 work on Optimal Currency Unions identified some key criteria that a successful currency union should meet:· Labour and capital mobility across the region

· Wage/price flexibility across the region

· Similar business cycles across the region

· A risk-sharing mechanism to allow stronger members to support weaker members.

Although capital is mobile across Europe, it fails the other tests. The Eurozone has significant language and cultural barriers that lead to much lower labour mobility than, say, the USA. When the ECB put up interest rates in the first half of this year to combat inflationary pressure in France and Germany, it did so knowing it would likely hurt the growth of weaker Euro members. And the Stability & Growth Pact contained no provisions for any form of risk-sharing mechanism – indeed it explicitly contained a ‘no bail-out’ clause. This was abandoned during last year’s sovereign debt crisis, and the European Financial Stability Facility (EFSF) effectively formalises the bail-out arrangements.So what’s the answer?

Three possibilities: muddle through, a partial break-up of the Euro, or full fiscal union. International bond investors are signalling the first alternative is unacceptable by demanding higher and higher interest rates to buy Eurozone government debt. German Chancellor Angela Merkel and French President Nicolas Sarkozy are jointly proposing full fiscal union (individual Eurozone members will lose their economic independence on decisions such as government spending), combined with strengthened bail-out arrangements via the EFSF.

A Level Business and Economics questions tend to be topical. We had prepared last year’s students for a question on the Eurozone, and the June 2011 Unit 4 Edexcel Economics A Level paper included a 30-mark question on the costs and benefits of Eurozone membership for the UK. The paper this year may include a question on the implications of full monetary and fiscal union.

Sunday, 30 October 2011

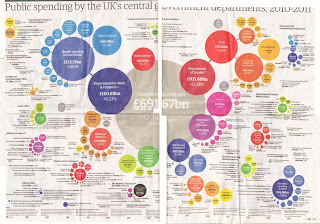

UK central government spending

The Guardian website has an excellent interactive guide to UK government spending, department by department:

http://www.guardian.co.uk/news/datablog/interactive/2011/oct/26/public-spending-uk-government-department?intcmp=239

If you're interested in the detail behind the data, and the key trends, then this article is for you:

http://www.guardian.co.uk/news/datablog/2011/oct/26/government-spending-department-2010-11

Finally, if you can't be bothered clicking through then I have cobbled together a rough scan of the newspaper article below (but you'll need to squint):

http://www.guardian.co.uk/news/datablog/interactive/2011/oct/26/public-spending-uk-government-department?intcmp=239

If you're interested in the detail behind the data, and the key trends, then this article is for you:

http://www.guardian.co.uk/news/datablog/2011/oct/26/government-spending-department-2010-11

Finally, if you can't be bothered clicking through then I have cobbled together a rough scan of the newspaper article below (but you'll need to squint):

Tuesday, 4 October 2011

Keynes vs Hayek

Check this link for the Fight Of The Century - Keynesians vs Monetarists, JM Keynes vs Hayek ...

http://www.youtube.com/watch?v=5dzhI3O6Brc

http://www.youtube.com/watch?v=5dzhI3O6Brc

Friday, 30 September 2011

Why is the stock market falling?

The FTSE 100 index of UK shares has fallen from over 6000 in July to just over 5000 now – a fall of 17%, and its worst quarterly fall in a decade. Why?

- Fears over growth

Economic growth in Europe and the US is stalling. Demand is weak, businesses and consumers lack confidence and inflation is rising leading the European Central Bank to increase interest rates.

- European debt crisis

Greece, Italy and Ireland have huge national debts, which they may not be able to repay given weak economic growth. So far countries have been reluctant to take the severe action needed to repay the debt – tax increases and huge cuts in public spending – as they have prompted popular hostility (and even riots in Greece).

- Lack of political leadership

Germany is reluctant to bail out the heavily indebted countries in the Eurozone, as its taxpayers’ money would have to be used. Barack Obama does not control Congress, so they may cancel his bailout plan. The private sector look to governments for leadership. Who will take charge of solving the problems?

Monday, 15 August 2011

Increasing savings rate in Mozambique to create economic growth

A story on the BBC website on how Mozambique is trying to persuade citizens to keep their savings in the bank, rather than under the mattress - so that banks can lend the money out to businesses wanting to invest and expand, creating jobs and economic growth.

This is an illustration of the Harrod-Domar model of economic development.

http://www.bbc.co.uk/news/world-africa-13984044

This is an illustration of the Harrod-Domar model of economic development.

http://www.bbc.co.uk/news/world-africa-13984044

Tuesday, 14 June 2011

The impact of the increasing minimum wage in China

The minimum wage in key coastal cities in China has increased by nearly 40% over the past 18 months, according to Stan Szeto, CEO of Lever Style Inc, a garment manufacturing business, during a Q&A session with A Level students at Crown Woods College. This is a result of the strong demand for labour in Chinese coastal cities, and of a change in government policy seeking to boost domestic demand.

His customers are mainly clothes retailers in recession-hit markets in Europe and the USA, so he is unable to pass on these increased costs in the form of higher prices – particularly given the appreciating Chinese currency.

In response, he is focussing on higher value-added market segments such as suits for high-end brands. These customers are willing to pay for the greater quality Chinese manufacturers can offer compared to countries with a lower wage cost such as Indonesia. Being fashion brands, they also value the increased flexibility of Chinese manufacturers who are able to offer substantially reduced lead times and get stock from design to shop-floor more quickly than manufacturers in low-cost countries. For customers who demand a simpler more commodity product, such as woven shirts, he is out-sourcing production to low-cost countries such as Indonesia.

He sees CRS as an essential part of their strategy to improve productivity and customer relations. He offers workers excellent working conditions, which helps attract and retain staff in the extremely tight Chinese labour market, and meets all customer compliance standards. Recently they have worked to reduce energy costs and emissions through the use of solar energy, and have partnered with the WWF on a low-carbon manufacturing programme. The lean production techniques he has introduced to reduce production lead times are also helping reduce his costs and improve employee motivation and productivity (just-in-time delivery; quality control circles; reorganising production into small multi-skilled teams instead of a continuous production line).

While European and US customers may be switching sourcing away from China owing to the increasing costs of production, Lever Style is finding the booming domestic market is taking up the slack.

Does this point the way forward for China - away from export-led growth based on low manufacturing costs, towards growth driven by booming domestic demand?

Subscribe to:

Comments (Atom)